The Profit and Loss (P&L) statement, also known as the income statement, is one of the three core financial statements used to report a company's financial performance. Analytically, it provides a detailed summary of a company's revenues, costs, and expenses over a specific period, such as a quarter or a fiscal year. Its primary function is to articulate a clear narrative of a company's ability to generate profit from its operations.

For any investor, executive, or business owner, a precise understanding of the P&L statement is not optional; it is fundamental. This document reveals the operational efficiency, pricing power, and cost structure of a business. By dissecting its components, an analyst can assess profitability trends, compare performance against competitors, and forecast future earnings potential. This guide offers a structured breakdown of the P&L statement, its components, and its indispensable role in financial analysis.

The Structure of a Profit and Loss Statement

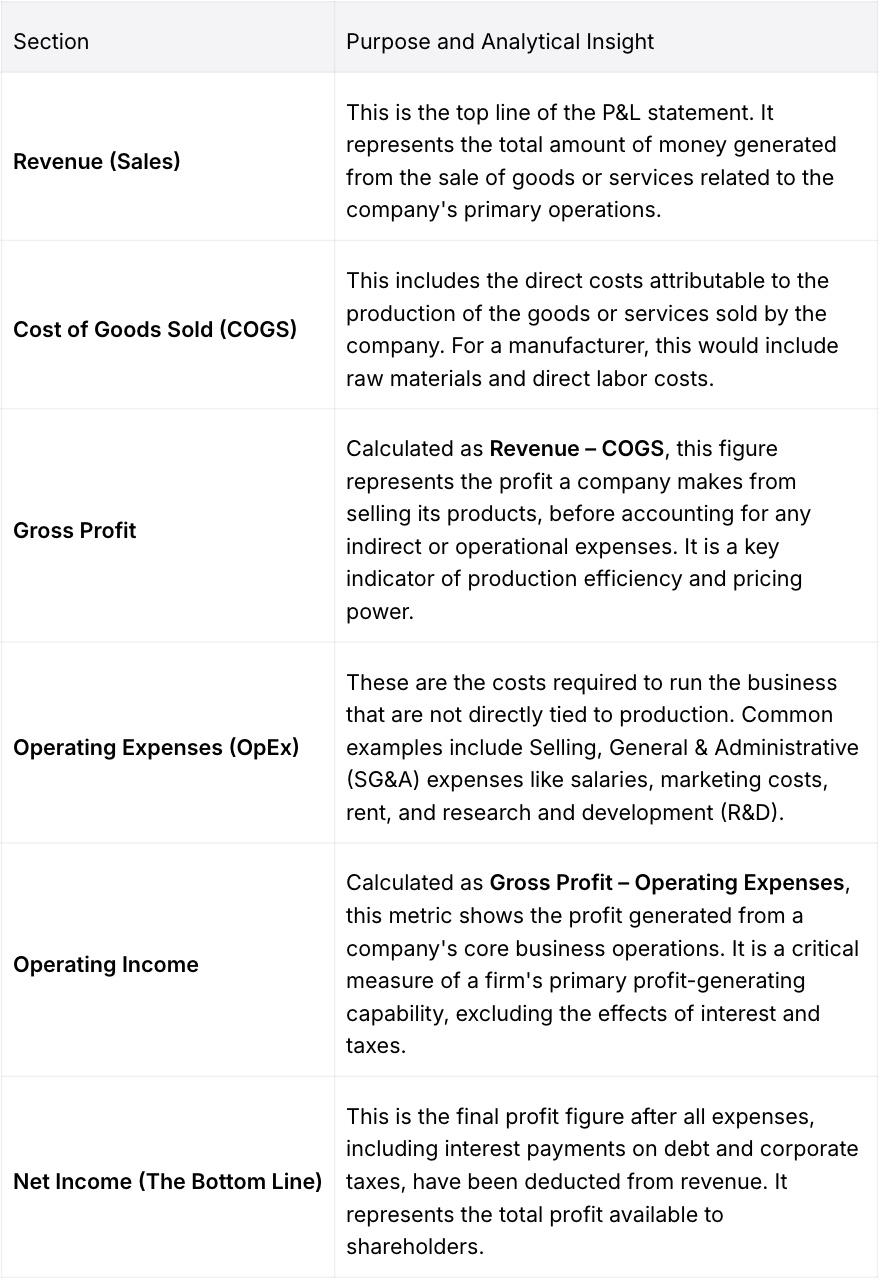

A P&L statement is organized logically, following a top-down approach that systematically subtracts costs and expenses from revenues to arrive at the final net income. This structure is designed to provide clarity on how profit is generated at different stages of the business operation. Each line item offers a distinct piece of analytical insight.

The standard structure can be deconstructed into the following key sections:

Why the P&L Statement Is Crucial for Analysis

The P&L statement provides a dynamic view of a company's performance over time, making it an essential tool for both internal management and external investors. Its importance is rooted in its ability to answer fundamental questions about profitability and operational efficiency.

First, it offers a clear measure of profitability. By analyzing metrics like gross profit margin, operating margin, and net profit margin, an investor can assess how effectively a company converts revenue into actual profit at different stages. A trend of expanding margins over time is a strong positive signal, indicating improved efficiency or pricing power.

Second, the P&L statement reveals a company’s cost structure. An analyst can examine the breakdown of COGS and operating expenses to understand where the company is spending its money. This allows for a detailed assessment of cost control and operational leverage. For instance, a software company with low COGS but high R&D spending has a fundamentally different business model than a retailer with high COGS and significant marketing expenses.

Finally, it is indispensable for forecasting. By analyzing historical P&L statements, analysts can identify trends in revenue growth, margins, and expenses to build models that forecast future performance. These forecasts are central to equity valuation and investment decision-making.

The P&L’s Relationship to Other Financial Statements

The P&L statement does not exist in a vacuum. It is intricately linked with the other two primary financial statements—the balance sheet and the cash flow statement—to provide a comprehensive view of a company’s financial health.

- Relationship to the Balance Sheet: The balance sheet provides a static snapshot of a company's assets, liabilities, and equity at a single point in time. The P&L statement connects two balance sheets over a period. Specifically, the Net Income calculated on the P&L statement flows into the Retained Earnings account within Shareholders' Equity on the balance sheet. A profitable company will see its equity base grow over time.

- Relationship to the Cash Flow Statement: The P&L statement is prepared using accrual accounting, meaning revenues are recognized when earned and expenses when incurred, not necessarily when cash changes hands. The cash flow statement reconciles this by tracking the actual cash movements into and out of a company. It starts with Net Income from the P&L statement and then makes adjustments for non-cash items (like depreciation) to arrive at the true cash generated by the business. A company can be profitable on its P&L statement but still face a cash crunch, a critical distinction that analyzing both statements makes clear.

Together, these three statements provide a holistic and multi-dimensional view of a company's financial position and performance, which is essential for any rigorous investment analysis.