In global financial markets, a select group of technology companies consistently commands attention. These are the FAANG stocks, an acronym representing five of the most dominant and influential corporations in the world: Meta (formerly Facebook), Amazon, Apple, Netflix, and Google (now Alphabet). These entities have not only redefined their respective industries but also fundamentally reshaped daily digital interactions.

The FAANG designation signifies more than just market leadership; it reflects a history of disruptive innovation, sustained growth, and substantial market capitalization. Their performance is a significant driver of major stock indices, and their strategic decisions create ripple effects across the global economy. For any investor seeking to understand the modern technology landscape, a clear, analytical grasp of FAANG stocks is indispensable.

What Are FAANG Stocks?

The term FAANG is an acronym that consolidates five of the most prominent American technology companies. This grouping has become shorthand for a specific class of high-growth, high-cap tech investments that have profoundly influenced market dynamics.

Origin and Evolution

The acronym was first popularized by Jim Cramer, host of CNBC's "Mad Money," in 2013. His original designation, FANG, included Facebook, Amazon, Netflix, and Google. The intent was to highlight a cohort of companies demonstrating complete dominance in their respective markets. In 2017, the acronym was updated to FAANG to include Apple, reflecting its undeniable status as a global technology leader and the world's most valuable company.

Significance in the Technology Sector

Each FAANG member holds a commanding position in its primary sector, creating vast ecosystems that are deeply integrated into modern life:

- Meta: Dominates social media with a portfolio including Facebook, Instagram, and WhatsApp, serving nearly four billion monthly active users.

- Amazon: Leads global e-commerce and has established a formidable presence in cloud computing with Amazon Web Services (AWS).

- Apple: Defines the premium consumer electronics market through its tightly integrated hardware and software, with the iPhone as its flagship product.

- Netflix: Pioneered the streaming entertainment model, fundamentally altering media consumption habits worldwide.

- Alphabet: Governs digital information access through its Google Search engine, alongside major ventures in cloud computing, AI, and autonomous vehicles.

Performance and Market Influence

The collective influence of FAANG stocks on financial markets is substantial. Their massive market capitalizations mean that their performance disproportionately affects major stock indices and, by extension, the portfolios of millions of investors.

Historical Performance and Market Capitalization

Over the past decade, FAANG stocks have delivered returns that have consistently outpaced the broader market. As of mid-2025, their combined market capitalization exceeded $11 trillion, highlighting their dominant influence on global equity markets and underscoring their systemic importance.

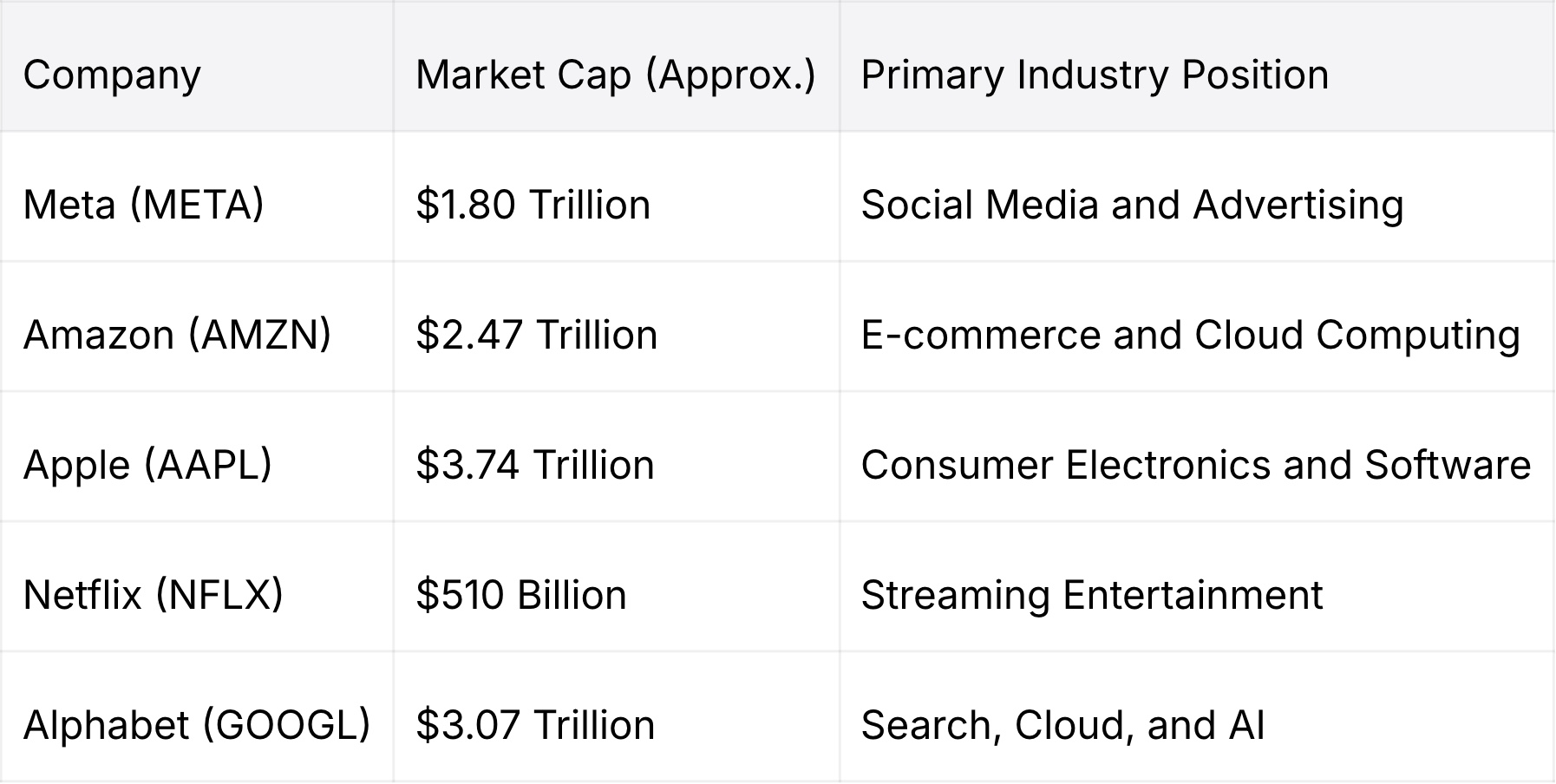

2025 Market Capitalization Overview:

Impact on Major Stock Indices

The weight of FAANG stocks in major market indices is a critical factor for investors to analyze. These five companies constitute a significant portion of benchmarks like the S&P 500 and the Nasdaq-100.

- They represent approximately 17-20% of the S&P 500's total market value.

- Their share of the tech-heavy Nasdaq-100 index is even more pronounced, approaching 40%.

This concentration means that significant price movements in any of the FAANG stocks can drive the direction of the entire market. Consequently, many investors have exposure to these companies indirectly through their holdings in index funds and ETFs, even if they do not own the individual shares. Their performance, hiring decisions, and capital expenditures send powerful signals throughout the economy.

Investing in FAANG Stocks

There are two primary methodologies for gaining exposure to FAANG stocks: direct purchase of individual shares and investment through diversified funds. The optimal approach depends on an investor's financial objectives, risk tolerance, and portfolio construction strategy.

Individual Stock Purchases

Purchasing shares of Meta, Amazon, Apple, Netflix, or Alphabet directly offers the highest potential for returns if a specific company performs exceptionally well. Most brokerage platforms provide commission-free trading and support fractional shares, making this approach accessible even with limited capital. However, this strategy also carries the highest concentration risk. An investor's returns become entirely dependent on the fortunes of a few select companies.

Exchange-Traded Funds (ETFs)

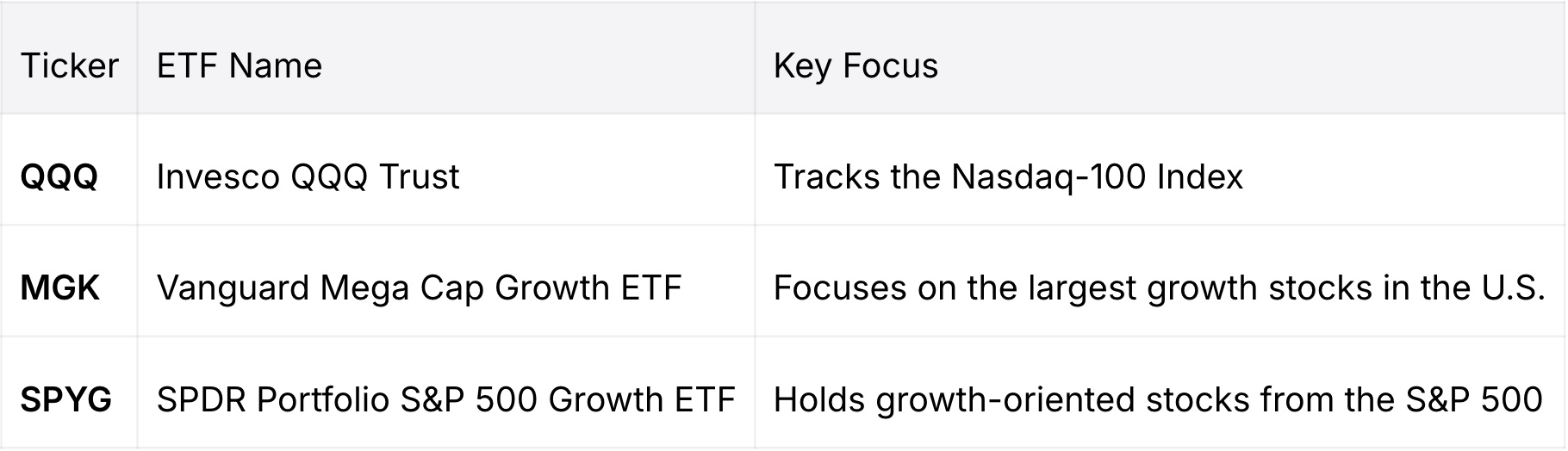

For investors seeking broader diversification, ETFs offer an efficient vehicle for FAANG exposure. Many funds that track major indices like the Nasdaq-100 or S&P 500 have significant allocations to these stocks. There are also thematic ETFs that specifically target large-cap growth or technology companies.

Examples of ETFs with Significant FAANG Exposure:

Investing via ETFs automatically diversifies risk across a wider basket of securities and reduces the burden of individual stock selection.

Potential Risks and Rewards

A balanced analysis requires weighing the historical strengths of FAANG stocks against potential future risks.

Potential Rewards:

- Market Dominance: Entrenched leadership positions create high barriers to entry for competitors.

- Strong Growth: A consistent history of revenue and earnings growth.

- Innovation: Substantial investment in research and development to fuel future technologies.

- Global Brand Recognition: Powerful and widely recognized brands across the globe.

Potential Risks:

- Regulatory Scrutiny: As their influence has grown, so has regulatory pressure related to antitrust, data privacy, and market power.

- High Valuations: Their stock prices often trade at a premium, which could increase downside risk during market corrections.

- Market Concentration: A portfolio heavily weighted toward FAANG stocks is exposed to risks specific to the technology sector.

- Competition: Despite their dominance, they face continuous competition from both established rivals and emerging innovators.

Ultimately, a prudent investment strategy should align with an individual's risk parameters and long-term financial plan. While past performance is no guarantee of future results, the structural importance of FAANG stocks in the global economy ensures they will remain a central topic of analysis for the foreseeable future.